What about multiples?

Over the past ten years, the valuation of publicly traded publishers has swung between the early euphoria around digital and a return to the very real constraints of the sector.

In 2014–2015, markets still saw digital books as a gold mine: the average multiple hovered around 0.75x revenue and even reached 9–10x EBITDA. The story sold well: higher margins thanks to fewer paper returns, tech synergies, lower distribution costs, and so on. The future looked bright.

Then exuberance faded. From 2016 to 2018, the curve dipped: –11% on revenue multiples, –22% on EBITDA. Two reasons: digital plateaued faster than expected and, above all, paper made a comeback. Printing and logistics costs rose, margins compressed, and expectations were revised. Back to the “mature industry” box.

The real surprise came from audiobooks. Between 2018 and 2019, the format grew by 25% in the U.S., reviving backlist value and attracting major players like Amazon (Audible) and Spotify. Multiples started to rise again, particularly revenue multiples climbing back above 0.8x. The market now values access to IP even when immediate profitability is modest.

2020 then hit: lockdowns, bookstore chains closed, maritime transport chaos. Against all odds, sales increased, driven by more home reading. But uncertainty about the right pricing level kept multiples flat.

It wasn’t until 2021 that a real catch‑up occurred: 825 million paper copies sold in the U.S. (+9%), a massive influx of private equity hungry for derivative rights, and multiples rising to 0.85x revenue and 8x EBITDA.

In 2022, inflation and higher interest rates tightened the spread again. Paper sold for more and risk perception increased; EBITDA was valued at only 6.8x on average. Big deals — e.g., KKR’s acquisition of Simon & Schuster (~2.4x sales) — nevertheless showed that premium catalogs can command above‑market prices.

In 2023, overall sales slipped slightly, mainly due to the school segment returning to normal after pandemic highs. Early 2024 turned positive again: 0.88x revenue (a 10‑year high) while EBITDA remained stable around 6.8x. Investors seek defensive cash flows, logistics costs normalize, and AI promises new revenue streams (automated translations, synthetic‑voice audiobooks, TV series adaptations).

A business valuation is your starting point for a successful sale.

A fair market valuation helps you reduce your tax burden, maximize your company's value, and strategically plan for the post‑transaction period.

GET YOUR FREE VALUATION →What about the Quebec industry?

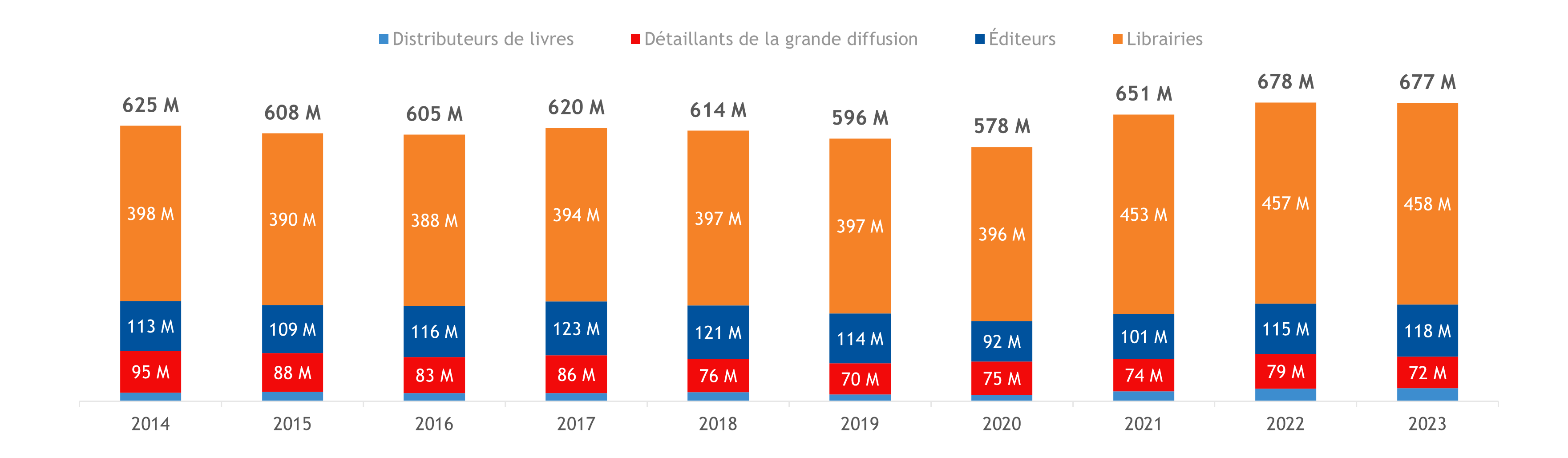

Over ten years of observation, one finding stands out: Quebec’s new book market is remarkably stable.

Aside from the pandemic dip, final sales of new books hover around $675M. The 3% drop recorded in 2020 was quickly recovered. Lockdowns boosted home reading, pushing sales to $651M in 2021 and an all‑time high of $678M in 2022. In 2023, sales fell by just 0.2% to $677.3M, still above pre‑COVID levels.

The four channels — bookstores, publishers, distributors, mass retail — stabilize overall sales: when one slips (e.g., mass retail), others offset. Bookstores remain the backbone: 68% of revenue and +15% since 2019. Direct sales by publishers ($118M) mark a third year of growth via rights sales outside Quebec. Even distributors (4%) hit a record $29M thanks to better networking outside the province.

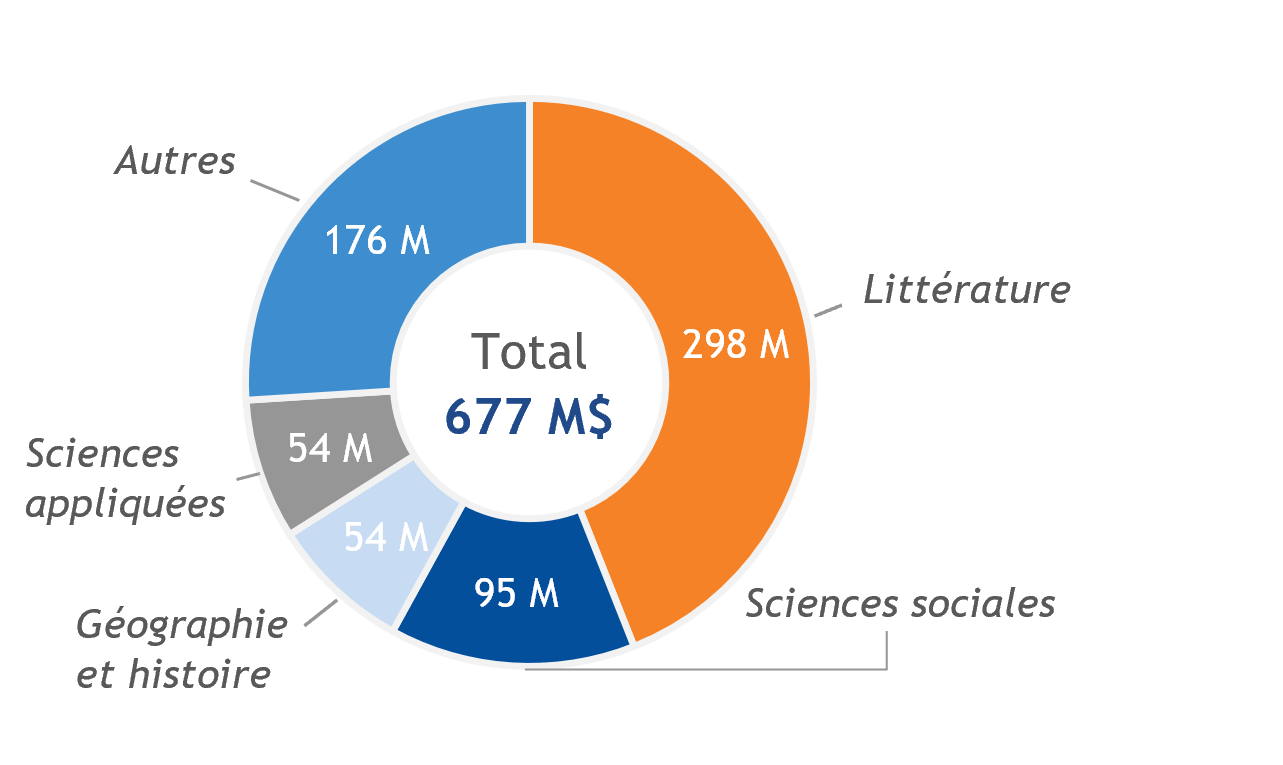

What about the different publishing domains?

General literature (novels, essays, comics, practical and children’s books) dominates: nearly one in two new books purchased in Quebec. Three other niches show more modest but strategic volumes: social sciences (~$95M), geography & history (~$54M), and applied sciences (~$54M).

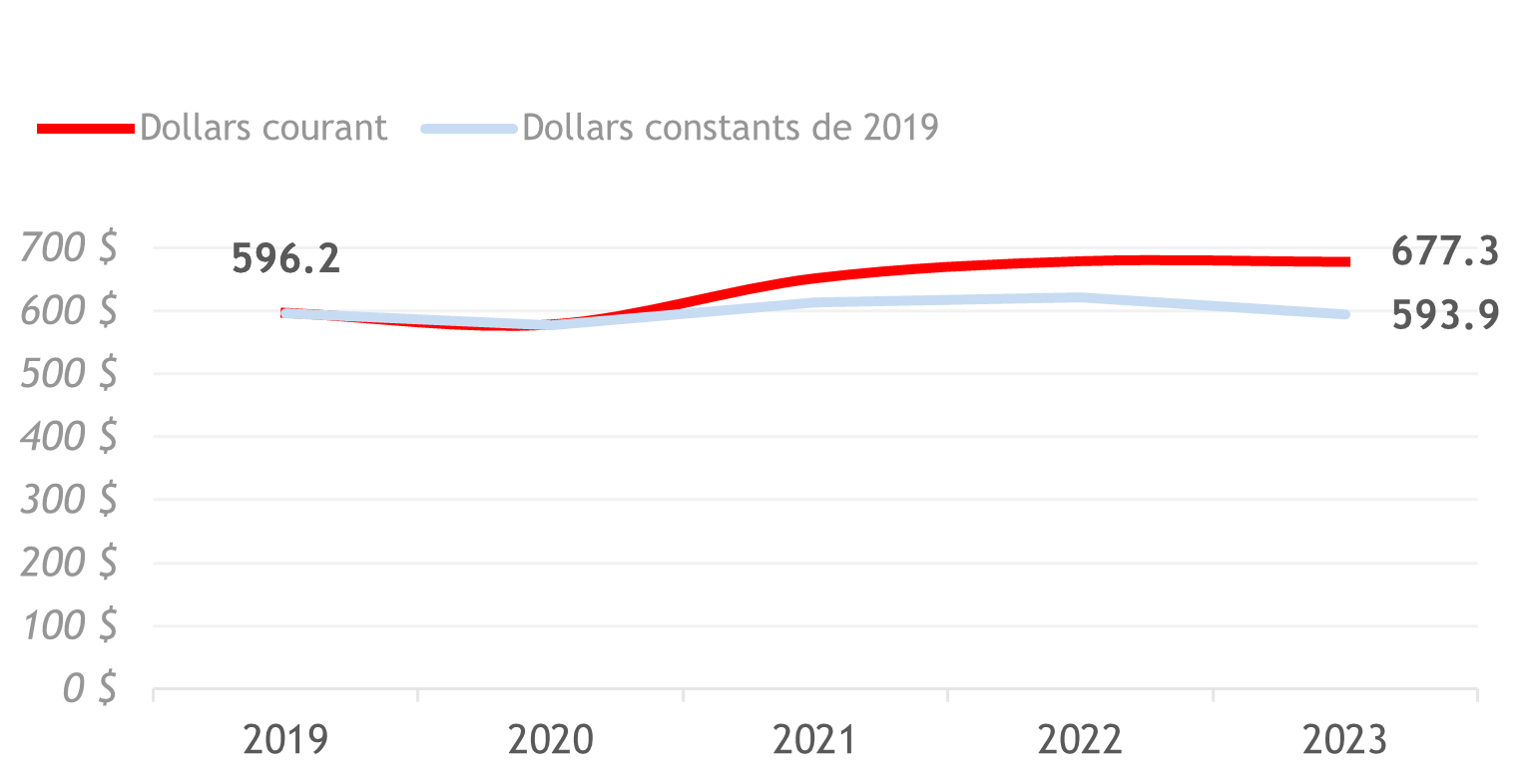

What about the impact of inflation?

In constant 2019 dollars, the nominal +13% increase from 2019 ($596M) to 2023 ($677M) nearly disappears: the real value returns to $594M (–0.4% vs 2019). The sector protected purchasing power amid rising costs. The CPI for “books and reading materials” rose +4.8% (2022→2023), while school textbooks climbed +2.9%.

Takeaways: pricing power remains solid (low‑ticket purchases → relative inelasticity), and cost control is critical. Optimizing print runs, favoring profitable digital formats, and investing in more carbon‑efficient logistics are key to preserving real profitability.

In conclusion

Quebec’s publishing industry shows undeniable resilience: rebound in valuation multiples, a domestic market anchored by bookstores, a diversified literary offering, and a proven ability to cope with inflation.

The real challenge now: controlling paper costs, accelerating digital and audio monetization, and striking a better balance between domains. For investors and industry leaders, the coming years look less like a bet on demand and more like a management and innovation challenge.